Medicare and some commercial insurance plans may cover Tirzepatide. Coverage varies based on individual plans and patient eligibility.

Tirzepatide, a medication for type 2 diabetes, has gained attention for its effectiveness. Patients seek insurance coverage to manage costs. Understanding which insurance plans cover Tirzepatide is crucial. Medicare and certain commercial insurance plans offer coverage, but it depends on specific plan details and patient qualifications.

Checking with your insurance provider is essential for accurate information. By knowing your plan’s coverage, you can better manage your treatment costs. Always consult your healthcare provider and insurance company to ensure Tirzepatide is covered under your plan. This proactive approach helps in making informed decisions about your diabetes care and financial planning.

Introduction To Tirzepatide

Tirzepatide is a new medication with great potential. It has shown promise in treating various conditions. Understanding its uses and benefits can help patients and healthcare providers.

What Is Tirzepatide?

Tirzepatide is a novel drug. It targets specific receptors in the body. This helps in regulating blood sugar levels. It is designed to aid in diabetes management.

Uses Of Tirzepatide In Medicine

Tirzepatide has several medical uses. It is primarily used for treating type 2 diabetes. It helps in controlling blood sugar levels effectively.

Below are some key uses of Tirzepatide:

- Improves blood sugar control

- Reduces the risk of heart disease

- Promotes weight loss

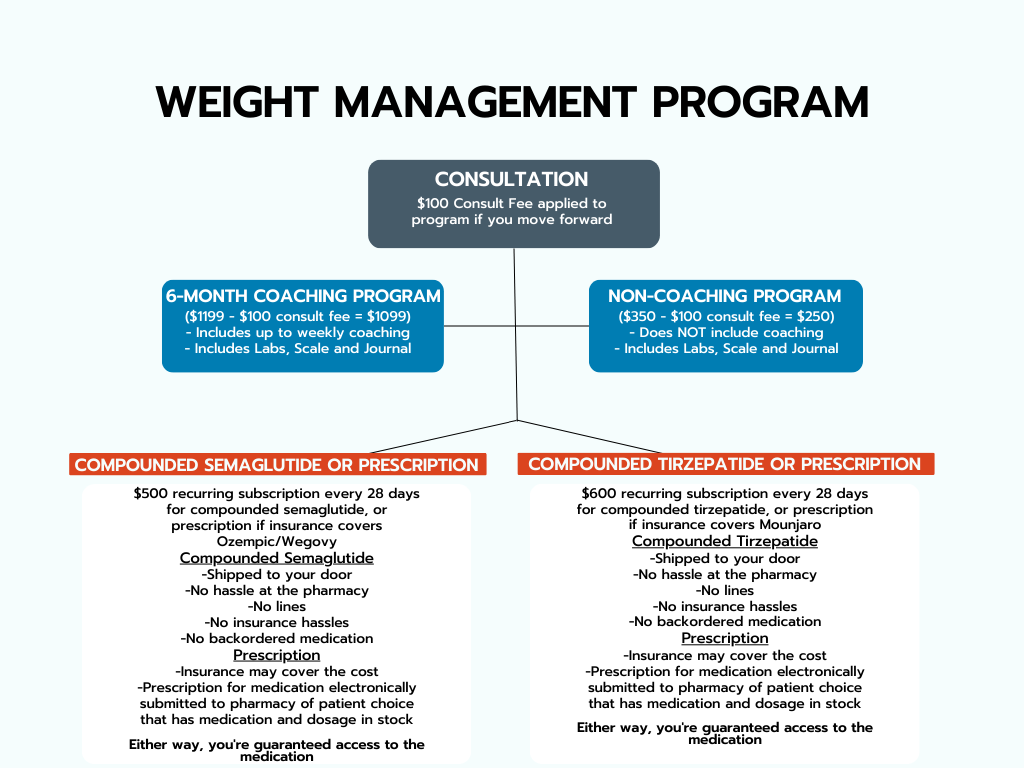

Credit: inspiremedicalcare.com

Navigating Insurance For Prescription Drugs

Understanding insurance coverage for prescription drugs like Tirzepatide can be complicated. Each plan has different rules and coverage levels. Knowing how to navigate insurance can save you money and time.

Factors Affecting Drug Coverage

- Formulary Lists: Insurance companies have lists of covered drugs.

- Tier Levels: Drugs are categorized into tiers. Higher tiers often mean higher costs.

- Prior Authorization: Some drugs need approval before coverage.

- Step Therapy: Insurers may require trying cheaper drugs first.

- Quantity Limits: Insurers may limit the amount of a drug covered.

Types Of Insurance Plans

Different insurance plans offer various levels of coverage for prescription drugs:

| Plan Type | Coverage Details |

|---|---|

| Employer-Sponsored Plans | Often have extensive formularies. May cover Tirzepatide but with cost-sharing. |

| Medicare Part D | Covers many drugs for seniors. Check the formulary for Tirzepatide. |

| Medicaid | State-funded and may cover essential drugs. Coverage varies by state. |

| Individual Plans | Coverage varies widely. Always check the plan’s formulary. |

Knowing the factors and types of plans helps you navigate insurance for Tirzepatide. Always review your specific policy details for the most accurate information.

Insurance Coverage For Tirzepatide

Tirzepatide is a new medication for diabetes management. Many are curious if their insurance covers it. Knowing your insurance options can save you money. Let’s explore the coverage details.

Private Insurance Policies

Private insurance often covers new medications. Check your specific policy for details. Coverage can vary widely between plans.

- Some policies cover Tirzepatide fully.

- Others may require a co-pay or deductible.

- Check for any prior authorization requirements.

Contact your insurance provider for exact coverage information. They can explain your benefits and out-of-pocket costs.

Medicare And Medicaid Considerations

Medicare Part D may cover Tirzepatide. Coverage depends on your specific plan. You may face different costs based on tiers.

| Medicare Coverage | Details |

|---|---|

| Tier 1 | Lowest co-pay, usually generic drugs. |

| Tier 2 | Medium co-pay, preferred brand-name drugs. |

| Tier 3 | Highest co-pay, non-preferred brand-name drugs. |

Medicaid coverage can vary by state. Check your state’s Medicaid formulary for Tirzepatide. Some states may require prior authorization.

Understanding your insurance coverage for Tirzepatide can help manage costs. Always confirm with your provider for the most accurate information.

Credit: zepbound.lilly.com

Evaluating Your Insurance Plan

Understanding your insurance plan is crucial for managing health costs. This includes knowing if it covers medications like Tirzepatide. Tirzepatide is a medication used to manage type 2 diabetes. It’s essential to evaluate your insurance plan to see if it covers this drug.

Understanding Your Policy’s Drug Formulary

A drug formulary is a list of medications your insurance covers. Each insurance plan has its own formulary. This list helps determine which drugs are covered and at what cost.

To find out if Tirzepatide is on your formulary, check your policy documents. These documents usually have a section dedicated to the drug formulary. You can also visit your insurance provider’s website.

Some plans have a tiered formulary system. Drugs are categorized into different tiers based on cost and coverage. Higher-tier drugs often mean higher out-of-pocket costs. Knowing which tier Tirzepatide falls into can help you plan your expenses.

Steps To Determine Coverage For Tirzepatide

Follow these steps to see if your insurance covers Tirzepatide:

- Review Your Policy: Check your insurance policy documents.

- Visit the Website: Go to your insurance provider’s website. Look for the drug formulary section.

- Contact Customer Service: Call your insurance provider. Ask if Tirzepatide is covered.

- Check Tier Placement: Find out which tier Tirzepatide is in. This affects your out-of-pocket cost.

- Consult Your Doctor: Speak with your healthcare provider. They can offer alternatives if Tirzepatide is not covered.

To help you understand better, here’s a simple table:

| Step | Action |

|---|---|

| 1 | Review Your Policy |

| 2 | Visit the Website |

| 3 | Contact Customer Service |

| 4 | Check Tier Placement |

| 5 | Consult Your Doctor |

By following these steps, you can better understand your insurance coverage. This will help you manage the costs of Tirzepatide more effectively.

Alternatives And Assistance Programs

When exploring insurance coverage for Tirzepatide, it is essential to consider alternatives and assistance programs. These programs can help manage costs and provide support for those who need this medication. This section dives into various options, including manufacturer assistance programs and strategies to save on costs.

Manufacturer Assistance Programs

Many drug manufacturers offer assistance programs for patients. These programs can provide free or discounted medication for those who qualify. To access these programs, you often need to fill out an application.

- Check the manufacturer’s website for specific details.

- Gather necessary documents, such as proof of income.

- Submit your application and await approval.

These programs aim to make Tirzepatide more affordable for everyone. They can be a valuable resource if you are struggling to cover medication costs.

Generic Options And Cost-saving Strategies

While a generic version of Tirzepatide is not available yet, there are other ways to save. Consider these cost-saving strategies:

- Use a prescription discount card. Many pharmacies offer these cards, which can reduce the price of medications.

- Shop around at different pharmacies. Prices can vary, so compare costs to find the best deal.

- Ask your doctor about alternative medications. Some other drugs may offer similar benefits at a lower cost.

These strategies can help reduce the financial burden of your prescription. Finding the right approach for your situation can save you money in the long run.

Credit: www.pacificheightsplasticsurgery.com

Frequently Asked Questions

Will Insurance Cover Tirzepatide?

Insurance coverage for tirzepatide varies. Check with your provider for specific details about your plan. Coverage depends on individual policies.

How Do I Know If My Insurance Covers Mounjaro?

Contact your insurance provider directly to check if they cover Mounjaro. Review your policy documents or visit their website.

How To Afford Tirzepatide?

Check insurance coverage, explore manufacturer discounts, and consider patient assistance programs. Consult your healthcare provider for affordable options.

How To Get Mounjaro For $25?

Get Mounjaro for $25 by using a savings card from the manufacturer’s website. Check eligibility requirements and apply online.

What Insurance Plans Cover Tirzepatide?

Coverage varies. Check with your insurer for specific details about Tirzepatide coverage.

Does Medicare Cover Tirzepatide?

Medicare may cover Tirzepatide if deemed medically necessary. Verify with your Medicare plan.

Is Tirzepatide Covered By Medicaid?

Medicaid coverage for Tirzepatide varies by state. Confirm with your state’s Medicaid office.

Can Private Insurance Cover Tirzepatide?

Yes, many private insurance plans may cover Tirzepatide. Contact your insurer for details.

Are There Co-pays For Tirzepatide?

Co-pays for Tirzepatide depend on your specific insurance plan. Check your plan details.

Is Tirzepatide Covered Under Employer Insurance?

Employer insurance plans might cover Tirzepatide. Consult your HR or benefits department.

Conclusion

Navigating insurance coverage for Tirzepatide can be complex. Check with your provider for specifics. Understanding your plan’s details ensures you’re prepared. Stay informed and proactive about your healthcare options. This can lead to better outcomes and cost savings. Keep researching and asking questions to make the best decisions for your health.